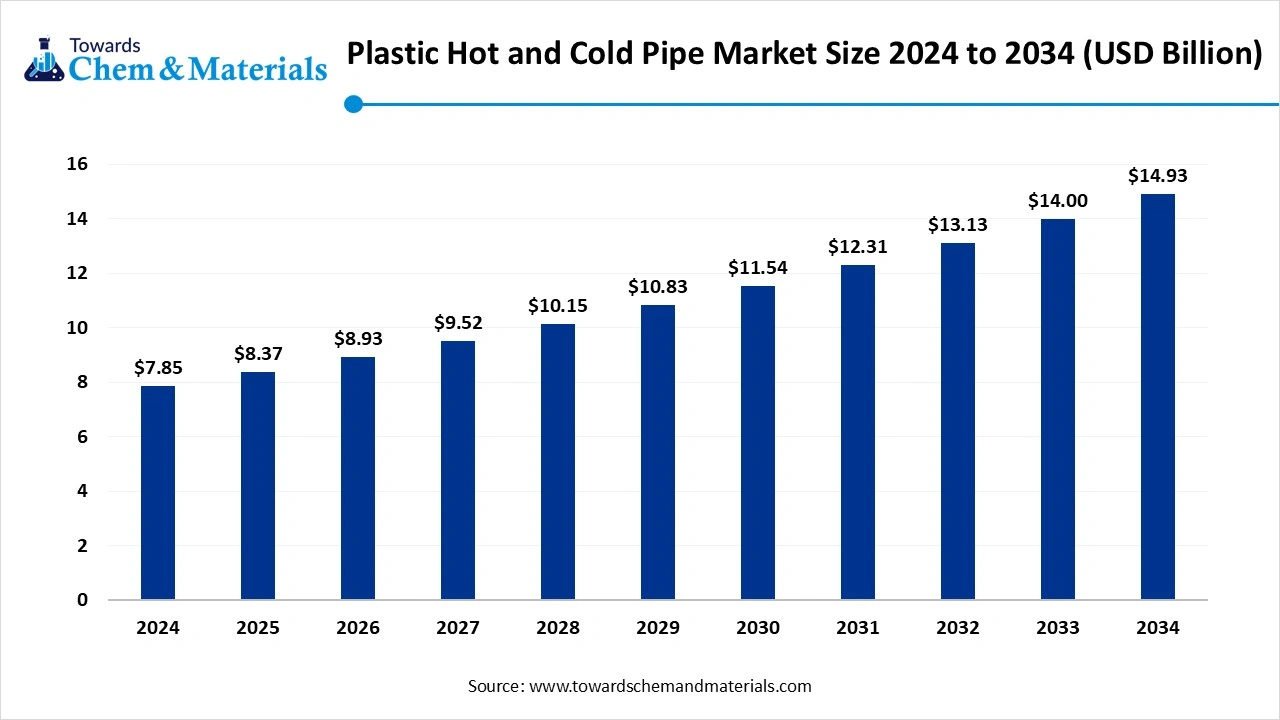

Ottawa, Oct. 09, 2025 (GLOBE NEWSWIRE) -- The global plastic hot and cold pipe market size was valued at USD 7.85 billion in 2024 and is anticipated to reach around USD 14.93 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.64% over the forecast period from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

The Rising demand for durable and cost-effective plumbing solutions in residential and commercial construction is driving the growth of the market.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5883

Plastic Hot and Cold Pipe Overview

The plastic hot and cold pipe market is driven by rapid urbanization and expansion of infrastructure projects, which fuels demand for new plumbing and heating systems, and the favourable attributes of plastic such as corrosion resistance, long lifespan, and ease of installation make these pipes an attractive alternative to metals, manufacturing are advancing polymer alternative to metals, manufacturers are advancing polymer blends, multilayer extrusion techniques, and smart plumbing integration to meet performance and sustainability expectations, while regional growth is strongest in Asia Pacific, with increasing interest in North America for future expansion.

Plastic Hot and Cold Pipe Market Report Highlights

- The Asia Pacific plastic hot and cold pipe market size was estimated at USD 3.53 billion in 2024 and is projected to reach USD 6.81 billion by 2034, growing at a CAGR of 6.79% from 2025 to 2034.

- By region, Asia Pacific dominated the market in 2024. The Asia Pacific region held approximately 45% share in the market in 2024.

- By material, the PEX segment dominated the market in 2024. The PEX segment held approximately 30% share in the market in 2024.

- By product form, the straight rigid pipe segment dominated the market in 2024. The straight rigid pipes segment held approximately 60% share in the market in 2024.

- By application, the cold potable water segment dominated the market in 2024. The cold potable water segment held approximately 40% share in the market in 2024.

- By end-use industry, the residential segment dominated the market in 2024. The residential segment held approximately 50% share in the market in 2024.

- By joining method, the fusion segment dominated the market in 2024. The fusion segment held approximately 40% share in the market in 2024.

Buy Now this Premium Research Report at a Special Price Against the List Price With [Express Delivery] @ https://www.towardschemandmaterials.com/checkout/5883

Plastic Hot and Cold Pipe Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 8.93 billion |

| Revenue forecast in 2034 | USD 14.93 billion |

| Growth rate | CAGR of 6.64% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2021 - 2024 |

| Forecast period | 2025 - 2034 |

| Segments covered | By Material Type, By Product Form, By Application, By End-User Industry, By Region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait |

| Key companies profiled | Wavin, Polypipe Group , Pipelife , IPEX Inc. , Rifeng Group , Vinidex , Sekisui Chemical , Krah Pipes , Finolex Industries , Astral Poly Technik , Prince Pipes & Fittings , Nupi Industrie Italiane, Dura-Line , Aquatherm, Salsa |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Here Are Some Of The Top Products In The Plastic Hot And Cold Pipe Market

PEX (Cross‑linked Polyethylene) Pipes

• Temp rating: up to ~ 93‑95 °C for continuous service.

• Flexible, reducing need for joints/elbows.

• Good resistance to chlorine, scale.

CPVC (Chlorinated Polyvinyl Chloride) Pipes & Fittings

• Hot & cold potable water use.

• Can handle ~ 82-95 °C depending on class/standard.

• Varying schedules / thickness (SDR 11, SDR 13.5, SCH 40 & 80) to suit pressure ratings.

PP-R / PP-R Random Copolymer Pipes

• Long service life (>50 years) under standard hot water conditions.

• Good temp tolerance (~ 95 °C), depending on wall thickness / class.

Multilayer Composite Pipes (MLCP, e.g. PEX-Al-PEX, PERT-Al-PERT)

• Combination of plastic + aluminium layers to give strength, reduce thermal expansion, provide oxygen barrier.

• Typical specs: up to ~ 95 °C, good pressure ratings.

PE-RT (Polyethylene of Raised Temperature Resistance)

• Non-crosslinked PE, designed for better high-temperature performance than standard PE.

• Often used in heating or systems with cyclic hot water demand.

HDPE (High‑Density Polyethylene)

• Very good toughness, chemical resistance; used more for cold or underground supply; hot water usage less common or limited.

PVC / uPVC

• For cold water, non‑pressure or lower pressure/higher temperature systems are not suitable.

Sintex HotX PRO MLCP Pipes

• A branded multilayer product that handles both hot & cold water, with a temp rating up to ~ 95 °C.

• Sizes (OD × wall thickness) examples: 16×2 mm, 20×2 mm, 25×2.5 mm, 32×3.0 mm.

Finolex CPVC Pipes (India)

• Available sizes: 15 mm to 50 mm in SDR 11 & SDR 13.5; also larger IPS sizes 65‑150 mm in Sch 40 & Sch 80.

• Working pressure & temperature (82 °C) specified; lengths 3‑5 m.

Astral CPVC Pro Pipes

• Wide product range, conforming to ASTM / Indian standards, with standard markings.

• Temperatures and pressure ratings per class/schedule; distinctive color coding etc.

What Are The Major Trends In The Plastic Hot and Cold Pipe Market?

- Rising use of specialty and bio-based polymers to meet sustainability goals and reduce the environmental impact of conventional plastic materials.

- Manufacturers pushing for advanced manufacturing methods such as multilayer extrusion and polymer blending to improve lifetime, thermal stability and mechanical performance.

- Increasing incorporation of digital monitoring/smart technologies (IoT, sensors, AI)for predictive maintenance, leak detection and operational efficiency.

- Greater demand for pre insulated and performance enhanced product forms and underfloor heating applications to enhance energy efficiency in residential and commercial infrastructure.

How Does AI Influence The Growth Of The Plastic Hot and Cold Pipe Market In 2025?

Artificial intelligence is influencing the growth of the plastic hot and cold pipe market in 2025 by transforming how manufacturing design, produce, and manage pipe systems. AI driven analytics are being integrated into production lines to optimize extrusion parameters, detect in real time, and enhance quality consistency, leading to more efficient material usage and reduced waste. In addition, predictive maintenance powered by AI us improving the reliability of plumbing systems by identifying early signs of leaks or pressure issues before they escalate. The technology is also enabling smarter demand forecasting, helping companies align supply chains with construction and infrastructure trends. Beyond manufacturing, AI supported smart plumbing systems are becoming part of connected building solutions, allowing real time monitoring of temperature, flow and performance, which enhances sustainability and operational efficiency across residential, commercial, and industrial applications.

Plastic Hot and Cold Pipe Market Dynamics

Growth Factors

Can Food Waste Turn Into Eco-friendly Plastics?

Biopolymers are gaining traction as scientists develop ways to convert agriculture and food waste into biodegradable plastics, reducing reliance on fossil fuels while promoting sustainability. This approach not only helps manage waste but also provides a low cost and renewable source of raw material.

Are Biopolymers strong Enough For Heavy Duty Use?

Advances in material science are enhancing the strength and versatility of biopolymers, such as using aligned bacterial cellulose to create sheets with strength and flexibility comparable to metals. These innovations expand their use in more demanding applications, from packagining to construction materials.

Market Opportunity

Is The Indian Plastic Pipe Industry Experiencing Growth?

The Indian plastic pipe industry is witnessing significant growth. Factors such as increased infrastructure development, government initiatives, and rising demand in sectors like agriculture and construction are contributing to this expansion. The market is expected to continue its upward trajectory, driven by these positive developments.

Limitations In The Plastic Hot and Cold Pipe Market

- Plastics pipes, while offering benefits like corrosion resistance and ease of installation, contribute to environmental concerns due to plastic production and disposable processes. The non-biodegradability of plastic production and disposal processes. The non-biodegradability of plastics raises issues regarding longer term waste management and pollution. This environmental footprint can deter adoption in regions with stringent sustainability regulations.

- Certain regions impose legal limitations on the use of plastic piping for specific applications, such as plumbing in floors or sink areas. These regulatory barriers can hinder the widespread adoption of plastic pipes, necessitating manufacturers to navigate complex compliance landscapes.

Plastic Hot and Cold Pipe Market Segmentation Insights

Material Insights

Why Is PEX Material Segment Preferred in The Plastic Hot and Cold Pipe Market?

The PEX segment dominated the global market in 2024 due to its flexibility, chemical resistance, and long-lasting performance in both hot and cold water applications. PEX pipes are easy to install and adapt well to modern plumbing systems, which makes them highly favored in residential and commercial projects. The increasing preference for durable and corrosion-free materials has strengthened the position of PEX in regions with intensive construction activity. Additionally, manufacturers are focusing on innovative formulations to further enhance the thermal stability and pressure endurance of PEX pipes, allowing them to cater to a wider variety of installation environments. These attributes collectively emphasize why PEX maintains a dominant position in the plastic pipe material segment.

The multilayer/composite segment is projected to experience rapid growth during the forecast period, due to its enhanced durability, improved thermal insulation, and superior resistance to both pressure and chemical corrosion. These pipes combine multiple layers of polymers to optimize performance in both hot and cold water applications, making them increasingly attractive for modern plumbing and industrial projects. The ability of multilayer/composite pipes to minimize heat loss, prevent scaling, and ensure long-term reliability has driven adoption in regions focused on energy efficiency and sustainability. Manufacturers are also exploring innovations that improve bonding between layers and increase flexibility, further boosting market growth. The combination of performance and sustainability considerations positions multilayer/composite materials as a key growth segment.

Product Form Insights

Why Are Straight Rigid Pipes Segment Dominating The Product Form Segment In Plastic Hot And Cold Pipe Market?

Straight rigid pipes segments captured largest market in 2024, widely used due to their structural stability and ease of integration with standard plumbing fittings. These pipes are especially preferred in large-scale construction and infrastructure projects where consistent pipe dimensions and minimal deformation are critical. The reliability and predictable performance of straight rigid pipes have made them the default choice for long-term water distribution networks. Additionally, their compatibility with automated installation systems and fusion joining methods enhances efficiency during construction. These factors collectively ensure that straight rigid pipes remain a dominant product form in the market.

Pre-insulated pipes segment are set to experience fast growth during the forecast period, because they offer superior thermal efficiency, reducing energy loss in heating and cooling systems. These pipes are increasingly deployed in commercial, industrial, and residential applications where maintaining temperature stability is critical. Pre-insulated solutions also reduce installation time and maintenance needs, making them economically attractive. Advances in insulation materials and integration with multilayer polymer technology further enhance their performance. As energy efficiency becomes a priority for construction and infrastructure projects, pre-insulated pipes are expected to expand rapidly.

Application Insights

Why Is Cold Potable Water Segment Dominant In Plastic Hot And Cold Pipe Market?

Cold potable water systems segment dominated the market in 2024, due to the need for safe, durable, and corrosion-free water distribution in both residential and commercial buildings. Plastic pipes provide an ideal solution for transporting drinking water because they are chemically inert, resistant to scaling, and maintain water quality over long periods. The ease of installation and lower maintenance requirements make these pipes especially suitable for urban infrastructure projects and modern plumbing networks. Furthermore, the ability to integrate with advanced plumbing systems such as manifold-based water distribution and automated flow control enhances their usability in large-scale projects. These factors collectively ensure that cold potable water remains a key application driving the market.

Underfloor and radiant heating systems segment are experiencing rapid growth in market during the forecast period, as modern building designs increasingly focus on energy efficiency and thermal comfort. Plastic pipes in these applications offer excellent heat transfer, flexibility for complex layouts, and compatibility with multilayer and pre-insulated technologies. Their durability and resistance to scaling and corrosion ensure long-term reliability, which is critical for embedded heating systems. The adoption of green building standards and demand for low-energy heating solutions are further driving the use of plastic pipes in this segment. As construction practices evolve toward sustainable and comfortable living spaces, underfloor and radiant heating applications are expected to grow substantially.

End Use Industry Insights

Why is the Residential Segment Dominant Plastic Hot And Cold Pipe Market?

The residential segment maintains a dominant position in the market in 2024, because of the widespread need for safe, efficient, and cost-effective plumbing solutions in new housing and urban developments. Plastic pipes are preferred for residential applications due to their ease of installation, corrosion resistance, and long service life. The increasing urban population and rapid construction of residential complexes amplify demand for modern piping systems. Additionally, compatibility with advanced water heating and distribution systems in homes reinforces the adoption of plastic pipes. These factors collectively establish the residential sector as a central driver of market growth.

The commercial segment expects the grow fastest in the market during the forecast period, to grow rapidly as new office complexes, hotels, hospitals, and retail spaces require efficient and reliable plumbing solutions. Plastic pipes provide durability, flexibility, and easy integration with complex plumbing layouts, which is essential in large commercial projects. They also reduce maintenance costs and installation time compared to traditional metal pipes, making them economically attractive. The increasing focus on sustainable building design and energy-efficient water systems further supports growth in this sector. As commercial construction expands, plastic pipes are set to become a key component of plumbing infrastructure.

Joining method Insights

Why is Fusion Segment Dominant Plastic Hot And Cold Pipe Market?

Fusion segment dominated the market in 2024, widely used due to its ability to create strong, leak-proof connections without additional adhesives or mechanical fittings. Fusion joining ensures long-term reliability in hot and cold water applications and minimizes maintenance requirements over time. This method is particularly suited for large plumbing networks in residential, commercial, and industrial projects where durability and safety are critical. Manufacturers and contractors prefer fusion techniques because they provide consistent performance and simplify complex installation processes. These benefits ensure fusion joining continues to dominate the market.

Mechanical or press-fit joining segment is experiencing fast growth during the forecast period, as it allows rapid installation and reduces the need for specialized welding equipment. Press-fit systems offer flexibility, ease of maintenance, and suitability for retrofit projects, making them increasingly popular in modern plumbing designs. These systems also ensure secure connections with minimal risk of leaks and can be applied in both residential and commercial buildings. Innovations in press-fit technology, including improved sealing mechanisms and compatibility with multilayer pipes, further boost adoption. As construction efficiency becomes a priority, mechanical joining methods are expected to see continued growth.

Regional Insights

Which Region Dominates the Plastic Hot and Cold Pipe Market?

Asia Pacific is the leading plastic hot and cold market in 2024 for plastic hot and cold pipes, driven by rapid urbanization, industrialization, and significant infrastructure development. Countries like China, India and Japan are major contributors to this growth, with increasing demand for modern plumbing solutions in residential, commercial, and industrial sectors. The region’s dominance is further supported by favourable government policies and investments aimed at improving water supply and sanitation networks. Additionally, the adoption of plastic pipes over traditional materials I son the rise due to their cost effectiveness and durability. This trend positions Asia Pacific as a key player in the market.

India stands out within the Asia Pacific region as a significant market for plastic pipes, particularly in applications like agriculture, plumbing, and infrastructure development. The country’s extensive use of plastic pipes in micro irrigation systems, such as drip and sprinkler irrigation, underscores their importance in enhancing water efficiency and crop yield. This widespread adoption is driven by the need for cost effective and durable solutions in rural and urban areas alike. Additionally, India’s growing construction and industrial sectors further fuel the demand for plastic piping systems. As a result, India plays a pivotal role in the expansion of the plastic pipe market within the Asia Pacific regions.

Why Is North America the Fastest Growing Region In The Plastic Hot And Cold Pipe Market?

North America is experiencing rapid growth in the plastic hot and cold pipe market during the forecast period, driven by several key factors. The region’s aging infrastructure is promoting significant investments in replacement and modernization projects, increasing demand for durable and cost-effective piping solutions. Additionally, the construction industry’s expansion, particularly in residential and commercial sectors, is fuelling the need for efficient plumbing systems. Technological advancements in manufacturing processes have led to improved product quality and performance, further boosting market growth. Government initiates promoting sustainable building practices and the adoption of eco-friendly materials are also contributing to the market’s expansion. These combined factors position North America as the fastest growing region in the plastic hot and cold pipe market.

More Insights in Towards Chemical and Materials:

- Mechanical Recycling of Plastics Market : The global mechanical recycling of plastics market size was reached at USD 37.85 billion in 2024 and is expected to be worth around USD 92.86 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.39% over the forecast period 2025 to 2034.

- Recycled Plastic Pipes Market : The global recycled plastic pipes market size was approximately USD 7.85 billion in 2024 and is projected to reach around USD 20.08 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 9.85% between 2025 and 2034.

- Carbon Fiber Reinforced Plastic (CFRP) Market ; The global carbon fiber reinforced plastic (CFRP) market size was approximately USD 19.85 billion in 2024 and is projected to reach around USD 48.08 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 9.25% between 2025 and 2034

- Commodity Plastics Market : The global commodity plastics-market size was valued at USD 498.55 billion in 2024, grew to USD 513.26 billion in 2025, and is expected to hit around USD 666.76 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.95% over the forecast period from 2025 to 2034.

- Plastic Injection Molding Market : The global plastic injection molding market size accounted for USD 12.45 billion in 2024 and is predicted to increase from USD 12.89 billion in 2025 to approximately USD 17.65 billion by 2034, expanding at a CAGR of 3.55% from 2025 to 2034.

- Corrugated Plastic Sheets Market : The global corrugated plastic sheets market size was valued at USD 1.85 billion in 2024, grew to USD 1.95 billion in 2025, and is expected to hit around USD 3.05 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.14% over the forecast period from 2025 to 2034.

- Plastic Compounding Market : The global plastic compounding market size was reached at USD 72.55 billion in 2024 and is expected to be worth around USD 148.83 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.45% over the forecast period 2025 to 2034.

- Biodegradable Plastics Market : The global biodegradable plastics market size was reached at USD 13.19 billion in 2024 and is expected to be worth around USD 91.26 billion by 2034, growing at a compound annual growth rate (CAGR) of 21.34% over the forecast period 2025 to 2034.

- Recycled Plastics In Green Building Materials Market : The global recycled plastics in green building materials market size was reached at USD 5.31 billion in 2024 and is expected to be worth around USD 12.24 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.71% over the forecast period 2025 to 2034.

- Microplastic Recycling Market : The global microplastic recycling market size was reached at USD 325.19 million in 2024 and is expected to be worth around USD 817.00 million by 2034, growing at a compound annual growth rate (CAGR) of 9.65% over the forecast period 2025 to 2034.

- Plastics Market : The global plastics market size was reached at USD 651.55 billion in 2024 and is expected to be worth around USD 984.11 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.21% over the forecast period 2025 to 2034.

- Plastic Lidding Films Market : The global plastic lidding films market size was reached at USD 3.33 billion in 2024 and is expected to be worth around USD 5.13 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.42% over the forecast period 2025 to 2034.

- U.S. Recycled Plastics Market : The U.S. recycled plastics market size was reached at USD 52.85 billion in 2024 and is expected to be worth around USD 131.33 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.53% over the forecast period 2025 to 2034.

- Asia Pacific Plastic Compounding Market : The Asia Pacific plastic compounding market size was reached at USD 33.85 billion in 2024 and is expected to be worth around USD 77.60 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.65% over the forecast period 2025 to 2034.

- Circular Plastics Market : The global circular plastics market size was reached at USD 73.19 billion in 2024 and is expected to be worth around USD 182.21 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.55% over the forecast period 2025 to 2034.

- Recycled Plastics Market : The global recycled plastics market size was reached at USD 83.19 billion in 2024 and is expected to be worth around USD 183.80 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.25% over the forecast period 2025 to 2034.

- Sustainable Plastics Market : The global sustainable plastics market size was valued at USD 410.73 billion in 2024, grew to USD 465.89 billion in 2025, and is expected to hit around USD 1,448.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 13.43% over the forecast period from 2025 to 2034.

- U.S. Transparent Plastics Market : The U.S. transparent plastics market size was reached at USD 20.02 billion in 2024 and is expected to be worth around USD 35.15 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.79% over the forecast period 2025 to 2034.

- U.S. Recycled Plastics in Green Building Materials Market : The U.S. recycled plastics in green building materials market size was reached at USD 846.20 million in 2024 and is expected to be worth around USD 1,941.65 million by 2034, growing at a compound annual growth rate (CAGR) of 8.66% over the forecast period 2025 to 2034.

- U.S. Plastics Market : The U.S. plastics market size was reached at USD 92.66 billion in 2024 and is expected to be worth around USD 131.34 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.55% over the forecast period 2025 to 2034.

Plastic Hot And Cold Pipe Market Top Companies

- Wavin: Innovates PPR and multilayer systems for hot/cold water in residential and commercial buildings.

- Polypipe Group: Offers sustainable plastic plumbing and heating systems for modern infrastructure.

- Pipelife: Supplies high-performance PEX and PP-R piping for HVAC and domestic water systems.

- IPEX Inc.: Specializes in thermoplastic piping solutions for hot/cold potable water.

- Rifeng Group: Major global supplier of PEX, PERT, and multilayer pipes.

- Vinidex: Delivers PEX and PP-R systems for plumbing and heating in Australia.

- Sekisui Chemical: Develops advanced cross-linked polyethylene (PEX) pipes.

- Krah Pipes: Limited role; focuses on large-diameter infrastructure pipes.

- Finolex Industries: Primarily PVC; limited hot water applications.

- Astral Poly Technik: Leading Indian brand in CPVC, PEX, and multilayer hot/cold systems.

Plastic Hot and Cold Pipe Market Top Key Companies:

- Wavin

- Polypipe Group

- Pipelife

- IPEX Inc.

- Rifeng Group

- Vinidex

- Sekisui Chemical

- Krah Pipes

- Finolex Industries

- Astral Poly Technik

- Prince Pipes & Fittings

- Nupi Industrie Italiane

- Dura-Line

- Aquatherm

- Salsa

Recent Development

- In July 2025, Rovanco Piping Systems Inc. and Brugg Pipes inaugural a $20 million plant in Illinois, dedicated to producing Rhino flex pre-insulted flexible pipes. This strategic move aims to enhance production capabilities and meet the growing demand for advanced piping solutions in various applications.

- In June 2025, Major commercial and municipal purchasers of PVC pipes in the U.S. have secured a preliminary $6 million class action settlement with the analytics firm OPIS, following allegations that several large PVC pipe manufacturers shared pricing data to coordinate prices.

Plastic Hot and Cold Pipe Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Plastic Hot and Cold Pipe Market

By Material Type

- Cross-linked Polyethylene (PEX)

- Polypropylene Random Copolymer (PPR / PP-RCT)

- Chlorinated Polyvinyl Chloride (CPVC)

- Polyethylene of Raised Temperature (PE-RT)

- High-Density Polyethylene (HDPE)

- Polybutylene (PB)

- Multilayer / Composite (PEX-Al-PEX, PE-AL-PE, etc.)

- Others (specialty engineered plastics)

By Product Form

- Straight rigid pipes

- Coiled flexible pipes

- Pre-insulated pipes

By Application

- Cold potable water distribution

- Hot potable water distribution

- Central heating (radiators, loops)

- Underfloor/radiant heating

- Chilled water / HVAC circuits

- Solar thermal/renewable heating

- Swimming pool & recreational water

- Light industrial process water

By End-User Industry

- Residential

- Commercial (offices, retail, hospitality)

- Institutional (schools, hospitals, government)

- Industrial

- Infrastructure & utilities

- Agriculture

By Joining Method

- Fusion (butt, socket, electrofusion)

- Mechanical (compression, press-fit)

- Solvent weld (PVC/CPVC specific)

- Flanged / adapter connections

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5883

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com